Employees are not required to make a contribution. SOCSO Contribution shall be made for each month of salary payment as a deduction towards salary net pay.

Social Protection For Foreign Worker

Upon expiry of the.

. The Employment Injury EI Scheme protects employees against accidents or occupational diseases arising out of and in the course of their employment. The use of new Identity CardIC No. Malaysian PR above 60 years old and Foreign Employees.

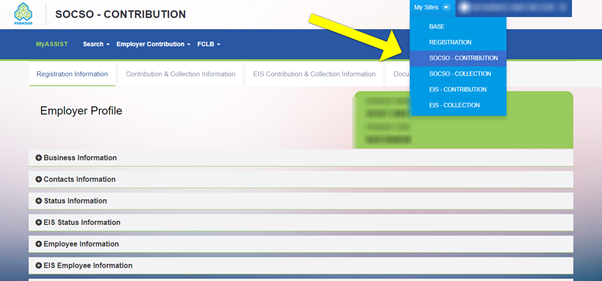

Login to your companys Assist portal account and follow the below screenshots. Foreign workers are exempted from employees social security SOCSO. 3 Year 2018 issued by SOCSO recently insurance coverage of foreign workers under the Foreign Workers Compensation Scheme FWCS from the Department of Labour will be transferred to SOCSO with effect from January 1 2019.

After you fill up the details of the staff save it and click next until you manage to click submit button and come to the below screen. Download the PDF files here. Beginning 1 January 2019 foreign workers must register with Social Security Organisation SOCSO and employers must contribute to the EI Scheme.

This is in line with. Shall be quoted when dealing with SOCSO on all matters related to foreign workers despite any changes to the workers particulars in the passport or valid working permit or equivalent document in the future. What is the contribution rate for employers and foreign workers.

Malaysia has agreed to open up more sectors for foreign workers from India says Human Resources Minister Datuk Seri M. The rate of contribution is 125 of the insured monthly wages and to be paid by the employer only referring to the Second Category Contribution Schedule for EI Scheme only. The percentage of SOCSO Contribution shall between 3 to 5 of the employee salary vary accordingly to the employee salary amount.

Malaysian PR below 60 years old Employee. When wages exceed RM30 but not RM50. With 12 digits or Socso Security Foreign Workers SSFW No.

The rate of contribution is 125 of the insured monthly wages and to be paid by the employer. KUALA LUMPUR Bernama. Employers SOCSO contribution rate Employees SOCSO contribution rate Age 60 and above 125 Employment Injury Scheme only 0 Age below 60 175 Employment Injury Scheme and Invalidity Scheme 05 Foreign workers 125 Employment Injury Scheme only 0.

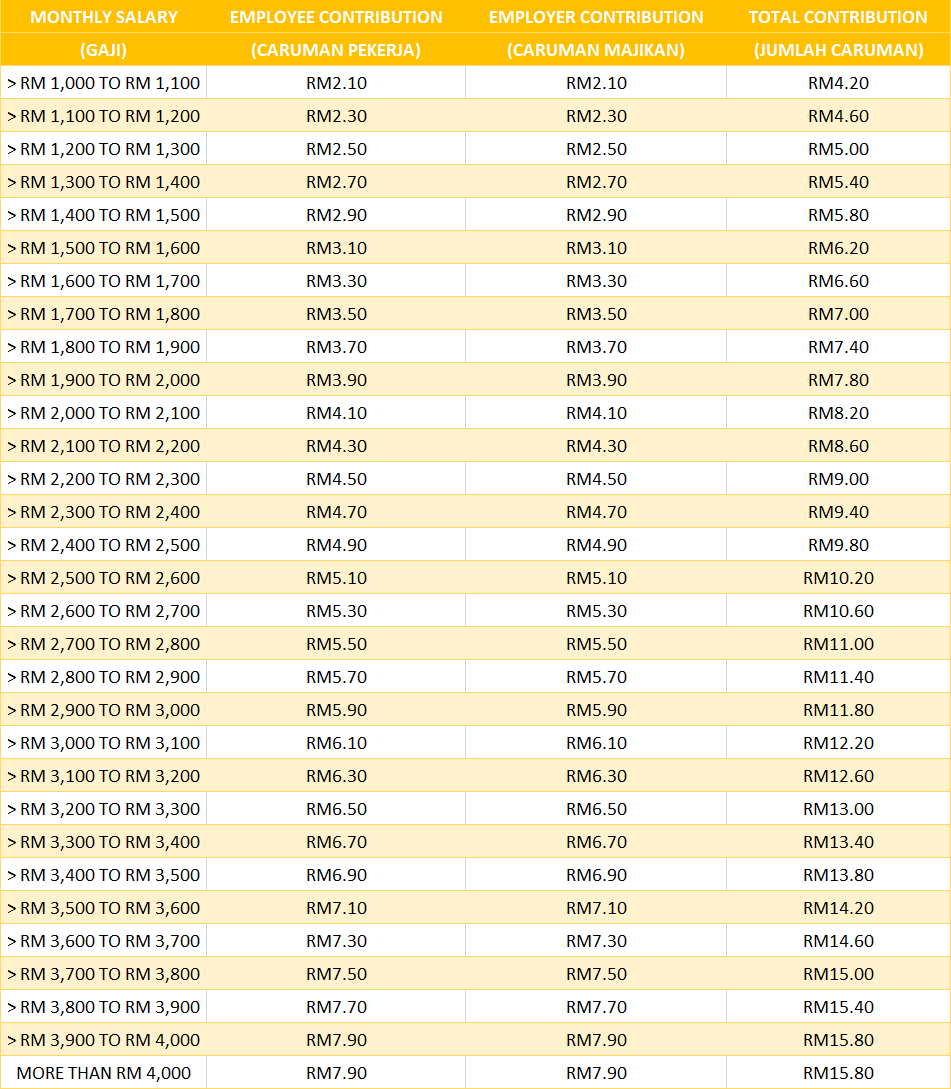

For foreign workers including expatriates only employers are required to contribute to SOCSO. Contribution Table Rates The contributions into the scheme depend on an employees monthly wage and it is contributed by both the employer and the employee. For better clarity do refer to the SOCSO Contribution Rate table-----Who is eligible for SOCSO deductions and contributions.

Is compulsory for any employee contribution record submitted. All contributions and payment history are being updated. Employers are required to contribute 125 percent of an employees monthly wages to SOCSO on a monthly basis subject to the insured wage ceiling of MYR 4000 per month and capped at MYR 4940.

Registration of foreign workers can be made online via the online Automated SOCSO Integrated System ASSIST portal or by completing the Foreign Worker Registration Form and submit it to the nearest SOCSO office with effect from 1 January 2019. Recently the Home Affairs Ministry and Human. Sep 12 2021 at 104 AM.

SOCSO will generate the Foreign Workers Social Security Number FWSS -12 digits for each registered foreign worker. The rate of contribution is 125 of the insured monthly wages and to be paid by the employer. Contribution By Employer Only.

Effective 1 January 2019 employers who hire foreign workers shall register their employees with Social Security Organisation SOCSO and contribute to the Employment Injury Scheme under the Employees Social Security Act 1969 Act 4. Wages up to RM30. The maximum eligible monthly salary for SOCSO contribution is capped at RM4000.

The amount paid is calculated at 05 of the employees monthly earnings according to 24 wage classes as in the Contribution Table Rates below along with the 175 contribution of the. Employees with a salary more than RM3000 per month are choose able to pay a SOCSO contribution. The Cabinet has decided to place social security protection of foreign workers under Social Security Organisation Socso with effect from Jan 1 2019.

1 Register the employee to SOCSO. Here are the steps of registration. Contributions using Lampiran 1 have been terminated.

The 12-digit FWSS No.

5 Things About Socso Perkeso You Should Know

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Foreign Workers Can Benefit From Socso The Star

Socso Opens Applications For Six Incentive Based Programmes

Employment Injury Scheme For Foreign Worker

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Socso Contribution Table Rates Jadual Caruman Socso Nbc Com My

Eis Perkeso Eis Contribution Table Eis Table 2021

Bispoint Group Of Accountants Who Should Contribute Pcb Epf Socso Eis What Is The Rate Of Contribution How To Calculate Pcb Http Calcpcb Hasil Gov My Index Php Lang Eng Socso Contribution Table Https Www Perkeso Gov My Index Php

Migrant Workers To Be Fully Socso Insured From Jan 1

.png)

Employers Must Know Employment Injury Scheme For Foreign Workers

Walk In Online Malaysia Foreign Worker Insurance Scheme Arranged By Acpg Management Sdn Bhd 03 92863323 011 12239838 Whatsapp Www Acpgconsultant Com Whatsapp For Enquiry Please Click Here Http Wasap My 601112239838 Foreignworkerinsurance Our

Foreign Worker Socso Eis Pcb Tax Epf Malaysia

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

What Is Socso Justlogin Help Center

5 Things About Socso Perkeso You Should Know